|

Topic: Banking

The Bank Account Document represents one of your company's actual Bank Accounts. If you are using salesorder.com to run your business then the balance and associated transactions should reflect those of the actual account it represents. Indeed, each Bank Account within salesorder.com can be reconciled with its real world counterpart.

As with its real world counterpart the Bank Account Document allows you to make deposits and transfers also record bank charges and interest payments.

NOTE: Credit Card and Petty Cash accounts are very similar to Bank Accounts. So if you need information on how to use these accounts simply use the help relating to Bank Accounts.

Prerequisites Using salesorder.com the basics

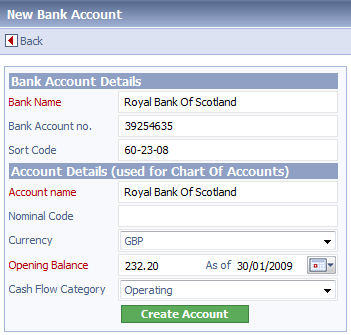

Creating a new Bank Account From the Explorer click Banking->Bank Accounts this displays the current list of Bank Accounts. From the Action Bar click 'New Bank Account'. This displays the new Bank Account page (below).

New Bank Account page

Bank Account Key Facts

NOTE: Once the Currency has been set it cannot be changed.

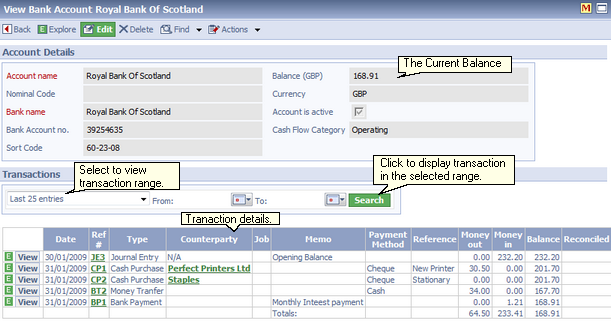

The Bank Account Document An example of the Bank Account Document is shown below.

The Bank Account Document

Once the Bank Account has been created you can then use it to enter transactions. For example,

Reconciling your bank statements Because the Bank Account Document represents one of your actual bank accounts there should be a one-one correspondence between the respective balances and associated transactions.

To check this is the case your bank statements should be reconciled against transactions held in the corresponding Bank Account Document in salesorder.com. The transactions are reconciled using a Bank Reconciliation Document. For more information see Reconcile your Bank Account.

Related tasks and information Transfer Funds from a Bank Account Working with Petty Cash Accounts Working with the Chart of Accounts

|