|

Topic: Banking > Working with Bank Accounts

Bank Deposit Documents represent a bank deposit slip you would use to deposit cheques and cash at your bank. In particular when you receive payment from a Customer by cheque or cash you would usually make the deposit to the bank at a later point in time. Until this point the money is located in a Non-deposited funds account.

Indeed for receiving payments from Customers the default account for the payment is Non-deposited funds. For payment that go directly into the bank, such as an electronic transfer, you have to specify the appropriate bank account.

So, in simple terms the Bank Deposit Document allows you to deposit cash currently held in your Non-deposited Funds account.

Prerequisites Using salesorder.com the basics

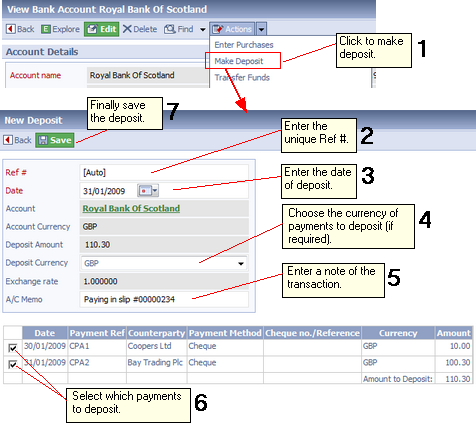

Creating a new Bank Deposit From the Explorer click Banking->Bank Accounts this displays the current list of Bank Accounts. Click 'View' against the account for which you want to make the deposit. This will display the required account. From the account's Action Bar drop-down click 'Make Deposit'. This displays the new Bank Deposit Document (below).

Making a Bank Deposit

The steps in the diagram show how a deposit is made.

IMPORTANT: Once a Deposit has been saved it cannot be edited, but it can be deleted.

NOTE: If a Payment has been deposited then you cannot edit the Payment. If you try to edit the Payment, salesorder.com will display an error. When you click on the 'Deposit' link in the error you will be taken to the Deposit Document on which the Payment is recorded.

Related tasks and information Working with Payments from Customers (Money In)

|