|

Topic: Sales

The Payment from Customer Document has three purposes:

IMPORTANT: If you use the Action 'Receive Payment' on the Customer Document, the Payment from Customer Document will display all of the Sales Invoices with outstanding balances for this Customer. If you use the Action 'Receive Payment' on a Sales Invoice Document, the Payment from Customer Document will only display this Sales Invoice.

Prerequisites Using salesorder.com the basics

Creating a 'Payment From Customer' Document The Payment From Customer Document can be created in two ways. Either from the Customer Document, or from a specific Sales Invoice. In both cases this is done by clicking the 'Receive Payment' action from the Action drop-down on the corresponding Document.

NOTE: Both these methods result in s similar Payment Document, however if you receive payment from the Customer you can pay all outstanding Invoices. Conversely, if you receive payment from the Invoice you only receive payment for that specific Invoice.

In this description we will assume you have clicked 'Receive Payment' from the Customer Document. The same details apply equally well to the specific Invoice payment.

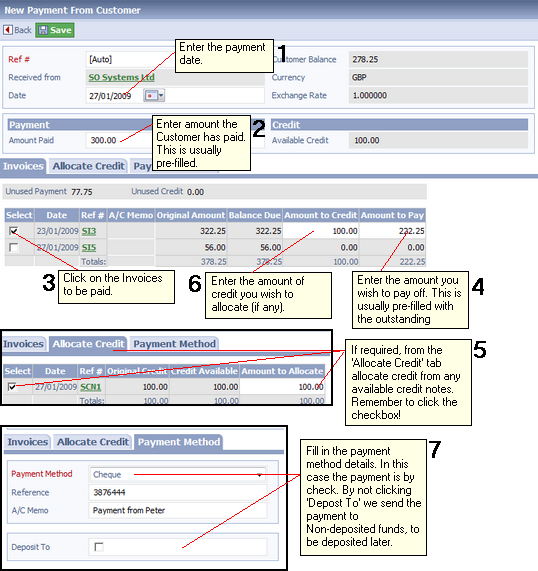

The Payment from Customer Document is shown below. The steps for completing the payment are labeled 1 through to 8. This is not as complicated as it looks! since in most cases you can simply use the pre-filled values. We have just used an example that, as well as cash payments, also allocates credit from a Customer Credit Note.

From the diagram above we will detail each step below.

1. Enter the date of the payment. This is the date you received the payment, not necessarily the date you deposited into the Bank (if it is a check).

2. Enter the actual amount you have been paid. This field is pre-populated with the outstanding amount owed on open Invoices, so in most cases you may not need to actually enter anything here.

3. Click on the 'Select' checkbox for the Invoice or Invoices you which to pay. When you click the checkbox you will notice the associated 'Amount to Credit' and 'Amount to Pay' fields become editable.

4. Enter the amount of cash you want paid against the Invoice. This is cash from the 'Amount Paid' field. NOTE: If you pay less total cash than the 'Amount Paid' the difference is displayed in the 'Unused Payment' field. Again when you first create a payment the amount of cash paid is already entered by default.

5. Click to the 'Allocate Credit' tab. In a similar way to the Invoices, this displays the currently available Customer Credit Notes. As with the Invoice, click on the appropriate 'Select' checkbox to make the 'Amount to Allocate' field editable. Then simply enter the amount of Credit You wish to allocate. In this case £100.

6. Now we allocate this credit to the Invoice. Go back to the Invoices tab an enter the £100 credit in the 'Amount to Credit' field. At this point we have paid the full Invoice amount i.e. £100 + £222.25 = £322.25.

7. Now we need to enter details of the payment. Go to the 'Payment Method' tab. We enter the payment method, which is a check, and a Reference which in this case is the check number. If we wanted to deposit the payment directly to a bank account (e.g. as with an electronic payment) we would click 'Deposit to' and select the appropriate bank. In this case we leave the depositing of the check until later. By default the payment is sent to the Non-Deposited Funds Account.

8. That's it! All you need to do now is save the Document. Of course this example has been made more complicated because of the assignment of credit.

Deposited Payments If the Payment was originally paid into the Non-Deposited funds account and subsequently deposited (paid in) to a Bank Account then you cannot edit the Payment. If you try to edit the Payment, salesorder.com will display an error. When you click on the 'Deposit' link in the error you will be taken to the Deposit Document on which the Payment is recorded. See Working with Deposits.

Related tasks and information Processing Credit Card Payments Working with Customer Credit Notes

|