|

Topic: Accounting > Working with the Chart of Accounts Overview Account Documents represent each of the basic accounts types detailed in the Chart of Accounts. For example you can create Balance Sheet Accounts such as Bank, Fixed Assets, Equity etc. Or Profit and Loss Accounts such as Income, Expense and Cost Of Goods Sold. When you create Transactional Documents, such as Sales Invoices or Bills the associated Line Items post their respective values to Accounts defined in the ItemAccounting tab.

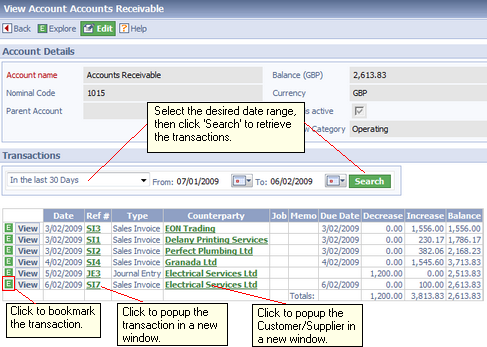

The Account Document allows you to view these transactions between a pre-specified or custom date range. This allows you to keep track of all sales and purchasing activity.

NOTE: Salesorder.com automatically ensures that all account postings from Transactional Documents conform to the Double Entry Bookkeeping methodology.

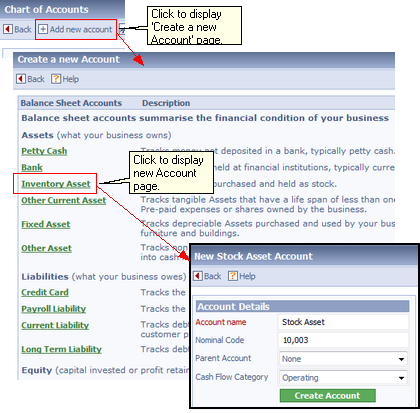

Creating a new Account The method of creating new accounts is basically the same regardless of the type of account. However there are subtle differences in the various different types. In this topic we show how to create new accounts highlighting the respective differences where appropriate.

From the Explorer click Accounts->Chart of Accounts this displays the Chart of Accounts. From the Action Bar click 'Add New Account', this displays the 'Create a New Account' page. From this page simply click on the type of account you wish to create, and the associated new Account Document will be displayed (below).

Creating a new Account

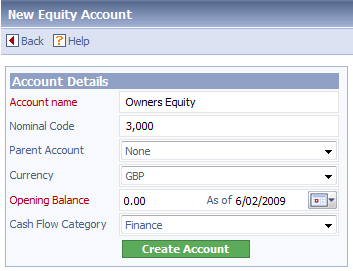

Common account details There are a number of common details which need to be completed when creating a new Account. We will use the New Equity Account page to describe each one (below).

Basic common account details

Account name The name of the Account. The Account name is mandatory and has to be unique.

Nominal Code This is an optional unique number associated with the Account. The numbers are primarily used by accountants to categorise the different types of account. The typical number ranges are shown below.

1000 - 1999: Asset accounts 2000 - 2999: Liability accounts 3000 - 3999: Equity accounts 4000 - 4999: Income accounts 5000 - 5999: Cost Of Goods Sold 6000 - 6999: Expense accounts 7000 - 7999: Other revenue (i.e. interest income) 8000 - 8999: Other expense (i.e. income taxes)

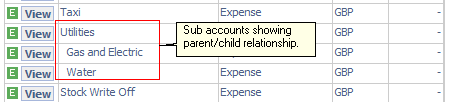

Parent Account You can specify a Parent Account here (which must be of the same account type). This allows you to group related accounts together within the Chart of Accounts. For example you may have expense accounts Gas and Electric/Water with a parent account of Utilities. Within the accounting reports this allows you to see at a glance the totals for Utilities, as well as for the constituent sub-accounts (below).

Example of Sub-accounts

Currency If you are using multiple currency specify the currency of the account here (see Working with Currencies).

Opening Balance If there is an initial balance for the account enter it here, together with the date from which the balance was effective.

Cash Flow Category This drop-down is specifically for the Statement Of Cash Flow report. It allows the account to be categorised into one of Operating, Finance or Investment.

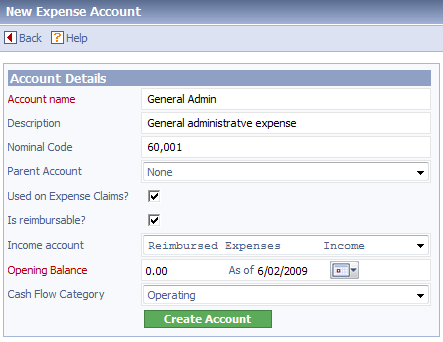

Expense accounts have a few additional fields which control how they appear on Transactional Documents such as Expense Claims and Sales Invoices (below).

Creating a new Expense Account

The additional fields are described below.

Used on Expense Claims Tick this box if you want the Expense to be available on Expanse Claim Documents. if the box is not ticked the Expense will not be displayed in the Line Item's 'Select an Expense' tab. See Entering Line Items.

Is reimbursable Tick this box if the Expense is reimbursable i.e. you can charge a Customer for the Expense, on say a Sales Invoice. If the box is ticked it will be available on the Sales Document's Line Item's 'Select Expense' tab. See Entering Line Items.

Income account If the Expense is reimbursable then by default the amount you charge will be entered into the Expense Account as a negative value. However, you may wish to treat money from reimbursed expenses as Income (i.e. revenue). In this case you can specify the associated Income Account in this drop-down. The default value of 'None' indicates an Income Account will not be used.

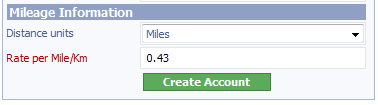

Sometimes you will want to book vehicle mileage expenses, in particular on Expense Claims. For convenience salesorder.com provides a special Mileage Expense account that allows you to specify both the distance units (Miles or Kilometers) and the cost per unit (i.e. Rate) in the base currency. When the mileage is entered onto an Expense Claim is then automatically populates the correct rate (below).

Extra fields on Mileage Expense

Creating Bank, Credit Card and Petty Cash Accounts These accounts relate to their real world counterparts. Although they can be created from the New Account page, just like any other account, they have special significance in salesorder.com and are dealt with as part of Banking. See Working with Bank Accounts for more details.

Once you have created your accounts, and specified the various account mapping in your Items, creating Transactional Documents such as Sales Invoices or Bills will post transactions to the appropriate accounts.

All Accounts have the facility to list the various transactions between a pre-specified or custom date range. Once listed the transactions can be popped into a new window by clicking their respective Ref # column, or bookmarked for future reference by clicking

Viewing Acount Transactions

Enabling account numbers (Nominal Codes) By default the Nominal Codes on Accounts are not visible when accounts are listed (such as in the Chart of Accounts, or on the Item's Accounting tab). If you want to display Nominal Codes simply set the appropriate option on the the Accounts Configuration Document.

Deleting Accounts An account can only be deleted if it contains no transactions. For more information see Voiding and Deleting Documents.

Related tasks and information Working with the Chart of Accounts Viewing Document Account Entries

|