|

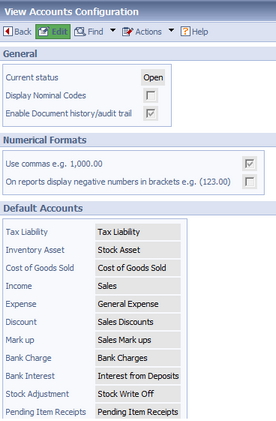

Topic: Setup > Configuration To configure Accounts, from the Explorer click Setup->Configuration. This displays the Configuration page. Then Click 'Accounts', this displays the Accounts Configuration Document (below).

Accounts Configuration Document

The various fields are described below.

General Section Current Status This is a read-only fields and shows if the Accounts are currently Open or Closed. If the accounts are Open then we can enter or modify transactions with any date. This enables us to retrospectively change transactions from previous financial periods if required. If the accounts are Closed then we cannot create or modify transaction before or including the last Close Date. See Closing the Accounts for more details.

Display Nominal codes If this box is checked the account Nominal Codes are shown both in the Chart of Accounts, and in the account selection drop-down lists (e.g. on the Item's Accounting tab).

Enable Document history/audit trail By default all Transactional Documents, such as Sales Invoices, have an audit history trail which records all the changes made to the Document, and by whom. This checkbox allows you to disable this feature. For more information see Transaction Audit Trail.

Numerical Formats Section Use commas By default numbers have comma separators per 1000. This checkbox enables/disables this feature.

On reports displaying negative numbers in brackets By default negative numbers are displayed using a '-' sign, as in normal arithmetic. For accountancy reports sometimes it is customary to display negative numbers using brackets instead e.g. -123.00 becomes (123.00). This checkbox enables/disables this feature. NOTE: This feature only applies to Reports.

Default Accounts Section This sections sets up the default accounts used by salesorder.com.

Tax Liability This account holds the Sales/Purchase tax liabilities (e.g VAT) resulting from Sales and Purchases.

Inventory Asset This is the default Stock Asset account for Stock Items (See Stock Item).

Cost Of Goods Sold This is the default Cost Of Goods Sold account for Stock Items (See Stock Item).

Income This is the default Income (i.e. revenue) account for Items (See Working with Items).

Expense This is the default Expense (i.e. revenue) account for Items (See Working with Items).

Discount This is the default Income (i.e. revenue) account for Discount Items (See Discount Item).

Markup This is the default Income (i.e. revenue) account for markup Items (See Markup Item).

Bank Charge This is the default Expense account for Bank charges (See Enter Payments to your Bank).

Bank Interest This is the default Income account for Bank Interest payments (See Enter Payments from your Bank).

Stock Adjustment This is the default account for Stock Adjustments (See Stock Adjustments).

Pending Item Receipts This is the default account for Items Receipts (See Working with Item Receipts).

Related tasks and information Working with the Chart of Accounts

|