|

Topic: Banking > Working with Bank Accounts

Because the Bank Account Document represents one of your actual bank accounts there should be a one-one correspondence between the respective balances and associated transactions.

To check this is the case your bank statements should be reconciled against transactions held in the corresponding Bank Account Document in salesorder.com. The transactions are reconciled using a Bank Reconciliation Document. This Document lets you mark each transaction in salesorder.com as reconciled when you have identified the corresponding transaction on your bank statement.

Prerequisites Using salesorder.com the basics

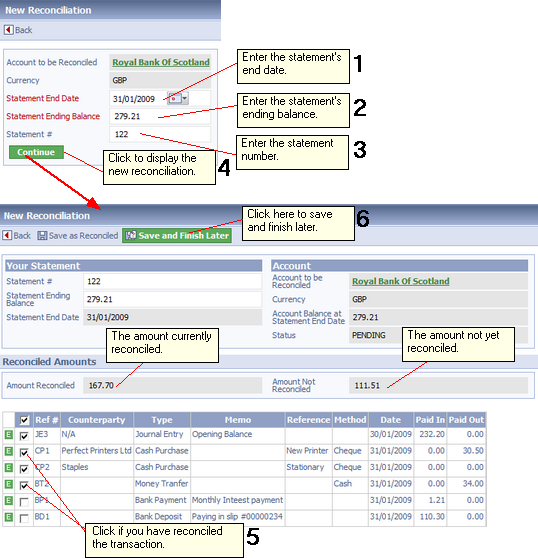

Creating a new Bank Reconciliation Find the Bank, or Credit Card account that you wish to reconcile. From the account's Action Bar drop-down click 'Reconcile'. This displays the new Reconciliation (below).

Reconciling your bank statement

The steps in the diagram show how reconciliation is performed.

NOTE: The statement has been reconciled when the Amount Not Reconciled amount is zero. A reconciliation cannot be Saved As Reconciled until this is the case.

USEFUL TIP: Reconciling bank statements can be a laborious process. Sometimes transactions are missing and you will have to retrospectively enter the missing transactions into salesorder.com. By clicking the Save and Finish Later button you can save the reconciled transactions, go and make the necessary additional entries/adjustments, then come back and continue with the reconciliation until complete.

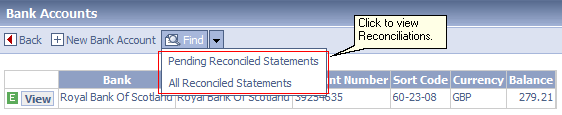

Finding currently pending and completed reconciliations To find previous reconciliations simply click on the Banking/Credit Card node on the Explorer. From the Action Bar drop-down click the appropriate action (below).

Listing Reconciliations

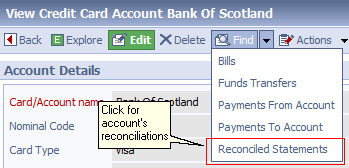

Also a particular account's reconciliations statements can be viewed from the account's associated Find menu (below).

Listing a specific account's reconciliations

Related tasks and information

|