|

Topic: Accounting

NOTE: For US companies please see Working with US Sales Tax

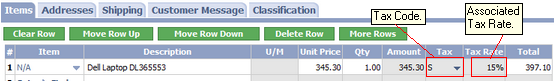

For UK companies Tax Codes represent those codes defined by HMRC for the VAT of sales and purchases. The Tax Code is typically applied to the Line Items on Transactional Documents such as Sales Invoices or Bills (below).

Tax Codes applied to Line Items

Each Tax Code has an associated Tax Rate, which defines the % rate at which tax will be charged.

NOTE: For UK Systems salesorder.com includes a set of pre-defined Tax Codes and associated rates in line with those issued by HMRC.

Prerequisites Using salesorder.com the basics

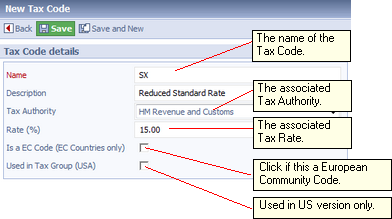

Creating new Tax Codes To create new Tax Codes, from the Explorer click Accounting->Tax->Tax Codes. This displays the current List of Tax Codes. From the Action Bar click 'Add New Tax Code' to display a new Tax Code Document (below).

New Tax Code Document

Once saved the new code, in this case SX at 15%, will appear in the Tax Code drop downs on Line Items. It will also be available for the default Tax Code settings on Customers, Suppliers and Items.

Trading with other European Union Countries (EC Member States) If you are a UK company trading with Companies from other countries in the EU, and they are registered for VAT, then they may have their own Tax Codes. For these codes tick the checkbox Is a EC Code. This enables the VAT Return to be completed correctly for transactions with other EC Member States.

IMPORTANT: If you are purchasing goods from a Supplier, and the Supplier is VAT registered make sure to check the 'Is from Other EC Member State' checkbox on the associated Supplier Document.

NOTE: Trading with other EC Member states may incur zero VAT, however the trading figures still need to be recorded on the VAT Return (i.e. the VAT100 form, boxes 2,8 and 9).

Related tasks and information Working with HMRC (UK Specific)

|