|

Topic: Accounting > Working with Tax Authorities HMRC (short for Her Majesty's Revenue and Customs) is the government body in the UK responsible for administrating, amongst other things, Value Added Tax (VAT).

In the UK companies with a turn over above a certain level have to be registered for VAT. Which means they charge VAT for products or services they sell, which ultimately has to be paid back to HMRC. Similarly they are charged VAT by UK suppliers, which can be claimed back from HMRC.

For small businesses that do not use a system such as salesorder.com, but rather use pencil and paper, or Microsoft Excel to keep track of their business, calculating the VAT to be paid or reclaimed can be very time consuming and error prone. If you get it wrong it can also be costly, since you can be fined for not paying on time or correctly.

Fortunately if you are using salesorder.com to run your business generating accurate VAT returns can be done automatically at the click of a button. Moreover the associated Invoice or Bill (depending on whether you need to pay or reclaim money from HMRC) will be generated with the associated VAT Return.

The HMRC Tax Authority, like a normal Supplier, keeps track of all the payments to and from HMRC. Like a Supplier it also has a current Balance which indicates whether you owe or are owed money.

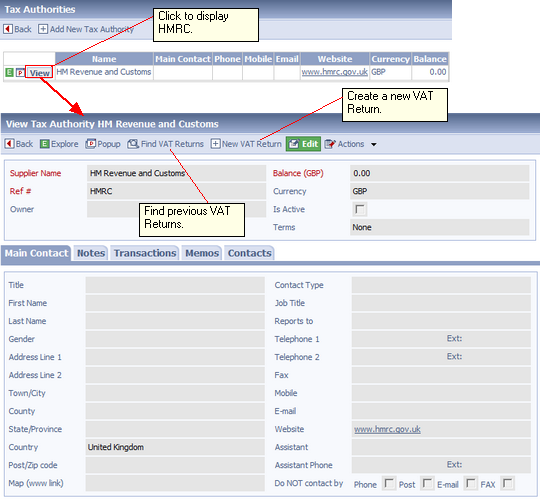

To view the HMRC Tax Authority, from the Explorer click Accounts->Tax Authorities. This will display the current list of Tax Authorities. HMRC has been added by default, and so will be listed. Simply click 'View' next to the HMRC entry. This will display the HMRC Document (below).

Viewing the HMRC Document

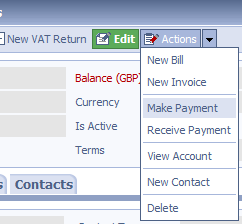

As mentioned previously you will notice many similarities with the usual Supplier Document. Notice that from the Action Bar we can create new VAT Return and Find previous Returns. Also from the Action drop-down we can enter Bills, issue Invoices (e.g. VAT refunds), and make or receive arbitrary payments from HMRC (below).

Actions available for HMRC

Related tasks and information

|