|

Topic: Accounting > Working with Tax Authorities > Working with HMRC (UK Specific) VAT Returns (i.e. the VAT100 form) can be generated automatically in salesorder.com. Provided you have entered all your purchases and sales using the Transactional Documents available (e.g. Bills, Sales Invoices etc), and provided you have used the correct Tax Codes in the associated Line Items you can generate a correct VAT Return Document from the HMRC Tax Authority Document.

As you can imagine this can save you a great deal of time and effort. Especially if you are used to using either pencil and paper or Microsoft Excel to run your business.

Once a VAT Return has been generated and you are happy with the figures it can be Filed. After filing a VAT return all associated Documents, such as Invoices and Bills will be locked. That is, you will not be allowed to modify (i.e. edit) the Documents. This is to preserve the integrity of the filed VAT Return, and the underlying transactions.

When the VAT Return is Filed either a Bill or Invoice will be generated automatically depending on whether you owe or are owed money from HMRC. These Documents can be viewed under the Transactions tab on the HMRC Document.

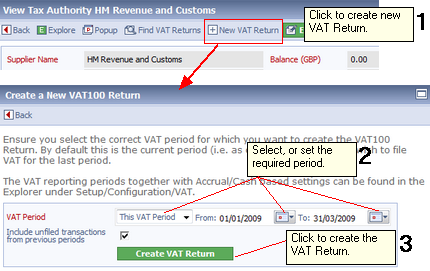

Creating a new VAT Return To create a new VAT Return first display the HMRC Tax Authority. From the Action Bar simply click 'New VAT Return' this will display a page from where you create the new VAT Return (below).

Creating a new VAT Return

NOTE: The new VAT page automatically defaults to your current VAT period. To set your VAT period, and other options, such as cash or accrual schemes, see Configuring VAT.

If you have unfiled transaction from previous periods they can be included in this return by checking Include unfiled transaction from previous periods.

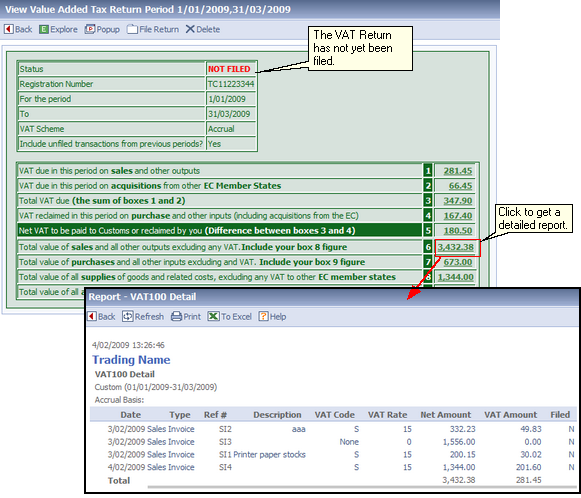

The new VAT Return is shown below. You will see that it looks similar to the VAT100 form supplied by HMRC. This makes it easy for you to fill in the form.

New VAT Return Document

The newly created VAT Return has the status of NOT FILED. This means that you can make adjustments to the underlying transactions, or create new ones until you are happy with the figures.

NOTE: As shown in the picture above, by clicking on the box figures you can view the associated transactions in a detailed report.

USEFUL TIP: If to want to view, modify or create Transactional Documents that contribute to you VAT Return, simply bookmark the VAT Return by clicking the

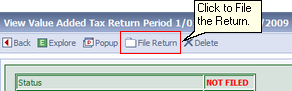

Filing the VAT Return Once you are happy with the VAT Return figures you can File the Return. this is done by simply clicking on 'File Return' on the VAT Return's Action Bar.

Filing a VAT Return

Filing the VAT Return has two effects,

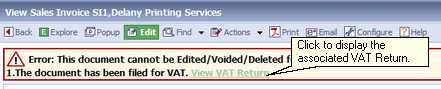

Locked Document message

NOTE: From a locked Document you can view the associated VAT Return.

Viewing HMRC Transactions

IMPORTANT:If you have Filed a VAT Return but have made a mistake and want to edited some filed Documents you must delete the associated VAT Return. You can then edit the Document and create/file a new VAT Return.

Viewing previous returns You can view previously created VAT returns, either filed or unfiled. To do this simply click 'Find VAT Returns' from the HMRC Document.

Related tasks and information |