|

Topic:

Accounting > Working with US Sales Tax

Overview

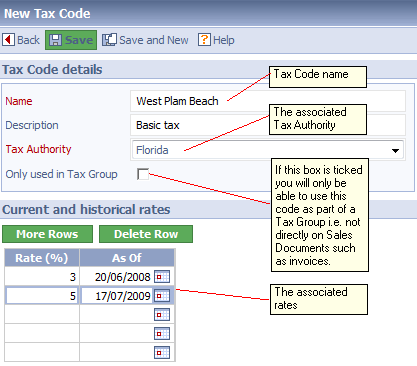

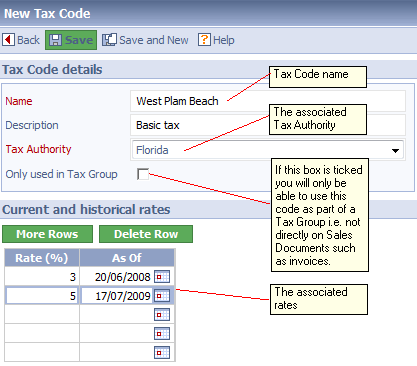

Tax Codes represent names and associated rates of tax set by specific Tax Authorities. For this reason Tax Codes are associated with their related Tax Authority via a drop-down list.

NOTE: You can assign a default Tax Code to a Customer so that when an associated Sales Document is created (such as a Sales Invoice), it will automatically be assigned the default Tax Code.

The Tax Code Document is shown below.

Entering Tax Codes

There are a few things worth noting.

| • | The Tax Authority drop down is mandatory. Each code must be associated with a specific tax Authority. |

| • | The field Only used in Tax Group requires a bit of explanation. Normally Tax Codes can be assigned directly to Sales Documents, such as Invoices. In some cases it may be necessary to group Tax Codes together in a Tax Group and apply the collective rate. If this Tax Code is to be used exclusively in Tax Group i.e. it is never applied in isolation, then ticking this box will remove it from the list of selectable Tax Codes on the Sales Documents. It is simply a method of reducing the number of selectable Tax Codes/Groups. |

| • | The current and historical tax rates are entered into the table. If there are no entries the rate is set to zero. |

Related tasks and information

Working with US Sales Tax

Working with Tax Authorities

Working with Tax Groups

Working with Item Tax Options

Working with Customers

|