|

Topic: Accounting > Working with US Sales Tax Tax Groups, as the name suggests, group together a set of related Tax Codes and present a single rate which is the sum of the constituent Tax Code rates. Tax Groups are used when you need to apply multiple Tax Rates to your Sales Line Items.

NOTE: You can assign a default Tax Group to a Customer so that when an associated Sales Document is created (such as a Sales Invoice), it will automatically be assigned the default Tax Group.

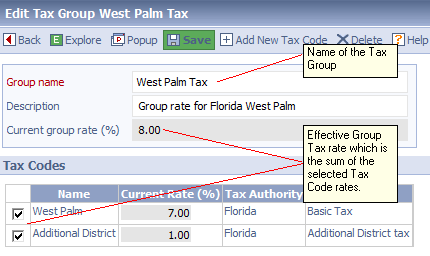

The Tax Group document is shown below.

Tax Group Details

NOTE: The Group tax rate is the sum of the selected Tax Code rates. As you select the appropriate Tax Codes you will notice the Group rate change accordingly.

Related tasks and information |