|

Topic: Accounting

Payment Terms allow you to specify the payment due date relative to the date of issue of the associated Transactional Document.

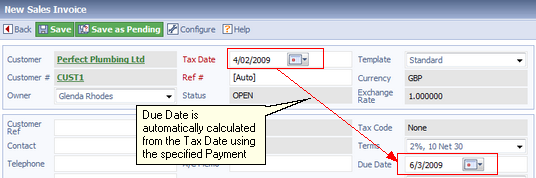

For example, the Payment Terms for a particular Customer may be 2%, 10 Net 30. This means that if a Sales Invoice was issued to the Customer on 4th February 2009 the payment would be due in 30 days time i.e. on the 6th March 2009. Also if payment is received within 10 days a 2% discount will be given.

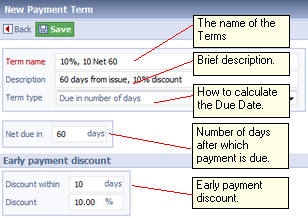

The Payment Term Document allows you to specify both the relative due date, and also the associated early payment discount.

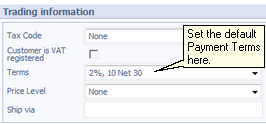

A Customer's (or Supplier's) default Payment Terms can be specified on the associated Profile Tab (below).

Setting Customer/Supplier default Payment Terms

When you create a Document from the Customer, such as a Sales Invoice, it 'inherit's the Payment Terms from the associated Customer and automatically sets the Due Date (below)

Automatic calculation of Due Date from Payment Terms

The same behaviour occurs on the purchasing side when, for example, you create a Bill from a Supplier i.e. the Bill's Due date is automatically derived from the payment Terms.

Prerequisites Using salesorder.com the basics

Creating new Payment Terms To create new Payment Terms from the Explorer click Accounting->Payment Terms. This displays the current List of Payment Terms. Click 'New Payment Term' to display a new Payment Term Document (below).

New Payment Term Document

The Term Type field determines how to calculate the Document (e.g Sales Invoice) Due date from the Issue Date. In this example it is set to Due In Number of Days which allows you to specify an absolute number of days in the Net due in field. Other possible values are,

You can create as many Payment Terms Documents as you wish.

Related tasks and information Working with Bills (Supplier Invoices)

|